Hybrid Crypto Exchange Development

Our hybrid crypto exchange development enables startups and entrepreneurs to launch their own hybrid crypto exchange software, combining the best features of both centralized and decentralized exchanges. It provides users with greater control over their funds while ensuring higher liquidity through a centralized order-matching algorithm. Hybrid crypto exchanges effectively address the challenges faced by both centralized and decentralized exchanges, offering a secure, efficient, and user-friendly trading experience.

What is hybrid crypto exchange software?

A hybrid crypto exchange software combines the advantages of both centralized and decentralized exchanges to offer a secure and efficient trading experience. It allows users to retain control over their assets while benefiting from high-speed transaction processing.

Centralized exchanges provide high liquidity and fast order matching but are prone to hacks and high transaction fees. On the other hand, decentralized exchanges ensure greater security and full asset custody for users but face scalability limitations.

By integrating the best of both, a hybrid crypto exchange offers high liquidity, robust security, efficient order matching, and full asset custody, making it an ideal solution for modern crypto traders.

Why Invest in Hybrid Crypto Exchange Development?

Market Growth Projection

The cryptocurrency exchange market is expanding rapidly, projected to grow from $37.23 billion in 2025 to $88.79 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 11.2%. This surge highlights the increasing demand for secure, efficient, and scalable trading platforms like hybrid crypto exchanges.

Rising User Adoption

The success of platforms like Hyper Liquid, which saw its Total Value Locked (TVL) skyrocket from $190 million in November 2024 to $2.16 billion, demonstrates the growing trust and adoption of hybrid exchange models.

CEX vs DEX vs Hybrid Exchange

| Feature | CEX (Centralized) | DEX (Decentralized) | Hybrid Exchange |

| Control Over Funds | ❌ Exchange-controlled | ✅ User-controlled | ✅ User-controlled |

| Liquidity | ✅ High | ❌ Low | ✅ Balanced |

| Security | ❌ Higher risk (hacks) | ✅ More secure | ✅ Stronger security |

| Speed | ✅ Fast | ❌ Slower | ✅ Fast |

| Regulation | ✅ Fully regulated | ❌ Often unregulated | ✅ More compliance-friendly |

| User Experience | ✅ Easy | ❌ Complex | ✅ User-friendly |

| Trading Fees | ❌ Higher fees | ✅ Lower fees | ✅ Competitive fees |

Premium Features of Our Hybrid Crypto Exchange Development

Our premium hybrid crypto exchange development has numerous features that make user more easy to trade and increase user based which helps startups to scale their business easily.

1. Smart Contract Integration

Smart contracts automate transactions by eliminating intermediaries, ensuring trustless and tamper-proof trading. These self-executing contracts reduce the risk of fraud and human errors, making the exchange highly secure and transparent.

2. Payment Gateway Integration

A hybrid exchange allows users to buy and sell cryptocurrencies using fiat payment methods such as credit/debit cards and bank transfers. This feature enhances user accessibility and encourages mass adoption by enabling seamless crypto-fiat conversions.

3. Order Book Model

The order book system in hybrid exchanges ensures real-time trade matching and liquidity, similar to centralized exchanges. This model allows traders to place market and limit orders, facilitating efficient price discovery and quick trade execution.

4. Aggregator Model

By aggregating liquidity from multiple exchanges, the hybrid model provides traders with better pricing, lower slippage, and higher execution speed. This feature is particularly useful for institutional traders and high-volume transactions.

5. Grid Model

The grid trading model automates buy and sell orders at pre-set price levels, helping traders capitalize on market fluctuations. This strategy minimizes manual intervention and ensures consistent profit opportunities, even in volatile markets.

6. Derivatives & Futures Model

Hybrid exchanges support advanced trading instruments such as futures contracts, perpetual swaps, and leverage trading. These features attract experienced traders looking for higher returns, risk hedging, and diversified investment strategies.

7. Crypto Swap

With the crypto swap feature, users can instantly exchange one cryptocurrency for another without relying on an order book. This simplifies trading, reduces waiting time, and provides a frictionless trading experience.

8. StableSwap

StableSwap is designed specifically for stablecoin trading with minimal slippage, making it ideal for large-scale transactions. By offering deep liquidity pools, hybrid exchanges enhance stablecoin trading efficiency and price stability.

9. AMM Model (Automated Market Maker)

Instead of traditional order books, the AMM model uses liquidity pools to facilitate peer-to-peer trading. This ensures continuous liquidity and efficient price matching, making it a key feature for DeFi integration.

User and Admin Features of Hybrid Crypto Exchange Development

| Admin Features | User Features |

| Robust Admin Panel Admin Dashboard Liquidity Pool Management Full Liquidity Order Book Escrow Management KYC Verification & Compliance Tools | Self-Explanatory User Dashboard Wallet Accounts Crypto Staking Crypto Farming Perpetual Trade Cross-Network Bridge Secure & Accelerated Transactions |

Security Features of Hybrid Crypto Exchange Development

Two-Factor Authentication (2FA)

Adds an extra layer of security by requiring a second verification step, protecting user accounts from unauthorized access.

KYC/AML Security

Ensures compliance with global regulations, preventing fraudulent activities and securing the platform against illicit transactions.

DDoS Protection

Safeguards the exchange from Distributed Denial of Service (DDoS) attacks, ensuring uninterrupted trading and platform stability.

SSRF Protection

Prevents Server-Side Request Forgery (SSRF) attacks, blocking malicious attempts to access internal systems and sensitive data.

End-to-End SSL Encryption

Encrypts all data transfers, protecting user transactions and sensitive information from cyber threats and hacking attempts.

Jail Login

Detects suspicious login attempts and prevents unauthorized access by locking accounts after multiple failed attempts.

Escrow Management

Enhances transaction security by holding assets in escrow until both parties fulfill their trade conditions, ensuring trustless settlements.

Institutional-Grade Security

Implements multi-layer protection, cold wallet storage, and advanced encryption, making hybrid exchanges as secure as top-tier financial institutions.

Benefits of Choosing Hybrid Crypto Exchange Development

Hybrid crypto exchange development offers numerous benefits for both users as well as entrepreneurs. They are

High Liquidity & Market Depth

Liquidity pools from centralized systems ensure seamless order matching, reducing slippage and enabling high-frequency trading. This makes hybrid crypto exchange development ideal for institutional investors and retail traders alike.

Institutional-Grade Security

Unlike CEXs, which are prone to hacks, hybrid exchanges store assets in decentralized wallets, protecting user funds from cyber threats. Multi-signature authentication, cold storage, and smart contract-based security further enhance protection.

Fast & Seamless Transactions

Hybrid exchanges match orders off-chain (like CEX) for instant execution but settle trades on-chain (like DEX) for security. This reduces delays caused by blockchain congestion, ensuring traders get the best price without waiting.

Transparency & Trust

Users get full visibility into transactions while still enjoying the flexibility of CEX-like trading, removing the fear of fund mismanagement. This ensures no hidden manipulations, wash trading, or price rigging.

Lower Transaction Fees

Hybrid exchanges optimize the fee structure by reducing network congestion costs (common in DEXs) while keeping operations efficient. This means users pay less while still enjoying fast, secure trades.

Decentralized Asset Ownership

Users control their private keys and assets, avoiding third-party control and reducing counterparty risks. Unlike CEXs, traders never have to worry about losing funds due to exchange shutdowns or fraud.

Compliance with Regulations

Unlike pure DEXs that often face regulatory hurdles, hybrid exchanges implement KYC/AML protocols, making them legally compliant and business-friendly. This attracts institutional investors and corporate clients, increasing adoption.

Scalability & High Performance

The hybrid model supports millions of transactions per second (TPS), making it ideal for large-scale trading without performance bottlenecks. This makes it suitable for global crypto adoption and mainstream financial integration.

Multi-Asset Trading Support

Supports multiple cryptocurrencies, fiat currencies, NFTs, and tokenized assets, expanding market opportunities for traders and investors. Users can trade seamlessly between various digital and traditional assets.

Revenue Diversification

Hybrid exchanges generate revenue through trading fees, staking, liquidity pools, premium memberships, and lending services, ensuring multiple income streams. This ensures sustainable business growth and profitability over time.

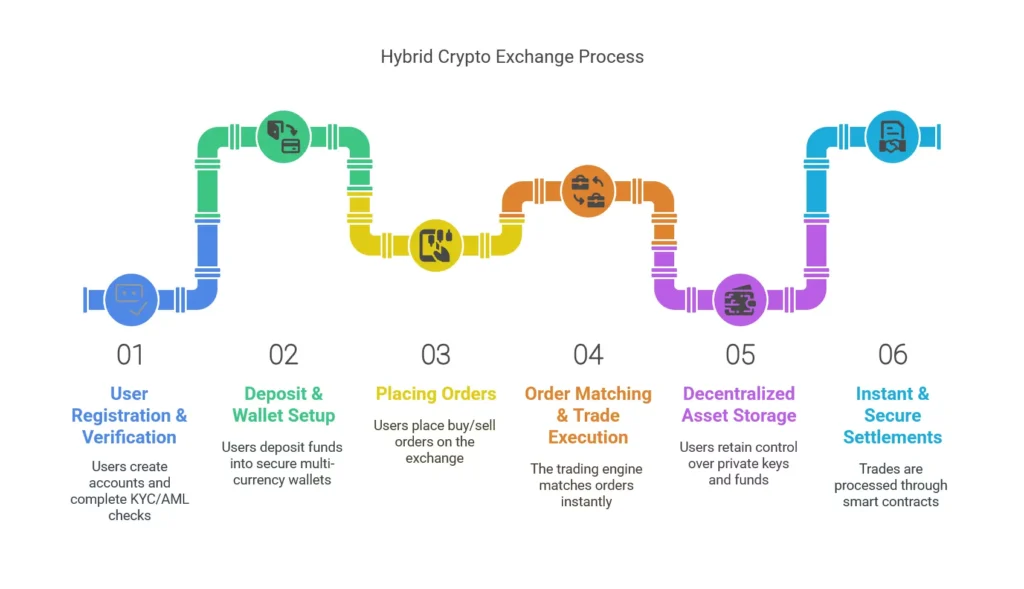

How Hybrid Crypto Exchange Works?

1. User Registration & Verification – Users create an account and complete KYC/AML verification to comply with regulations and enhance security.

2. Deposit & Wallet Setup – Users deposit funds into their secure multi-currency wallets, supporting both fiat and cryptocurrencies.

3. Placing Orders – Users can place buy/sell orders like on centralized exchanges, benefiting from deep liquidity and fast order execution.

4. Order Matching & Trade Execution – The exchange’s trading engine matches orders instantly, ensuring seamless transactions with low latency.

5. Decentralized Asset Storage – While trading is fast, users retain control over their private keys and funds with secure non-custodial wallets.

6. Instant & Secure Settlements – Trades are executed efficiently, with transactions being processed through smart contracts for added security.

7. Withdraw Funds – Users can withdraw assets anytime to their external wallets, with additional security layers like multi-signature authentication.

8. Earning Opportunities – Users can stake crypto, participate in lending, and earn from liquidity pools to maximize their returns.

How to Develop a Crypto Exchange? In 5 Steps-by-Steps

Developing a hybrid crypto exchange involves multiple phases, from conceptualization to deployment, ensuring a secure and high-performance platform.

Project Analysis

The development starts with a comprehensive analysis of business requirements, target audience, compliance needs, and technical feasibility. Market research is conducted to understand competitors, trading trends, and security challenges to create a robust exchange strategy.

Designing

The platform’s UI/UX is designed for intuitive navigation and seamless trading. Wireframes and prototypes are developed to ensure a user-friendly experience for traders and administrators. The design focuses on high-speed order execution, real-time data visualization, and an engaging trading dashboard.

Development

The hybrid exchange is built using advanced blockchain frameworks and smart contract integration. Key components include order matching engines, liquidity management systems, KYC/AML verification, and multi-layered security protocols. Smart contracts ensure transparent and automated transactions while API integrations allow seamless connectivity with payment gateways and liquidity providers.

Testing

Rigorous testing is conducted to ensure the platform’s security, scalability, and functionality. This includes unit testing, load testing, security audits, and real-time trading simulations. Penetration testing is performed to identify vulnerabilities and strengthen security layers before deployment.

Deployment

Once testing is complete, the exchange is deployed on secure cloud servers and blockchain networks. Continuous monitoring and updates are implemented to ensure smooth trading operations, regulatory compliance, and protection against evolving cyber threats. Post-launch support includes bug fixes, security updates, and performance optimizations.

Tech Stack for Developing Hybrid Crypto Exchange Development

1. Blockchain Platforms

The foundation of the exchange relies on reliable blockchain networks for transaction security, smart contract execution, and decentralization.

- Ethereum – Smart contract execution, ERC-20 & ERC-721 token support

- Solana – High-speed transactions, low fees, scalability

- Binance Smart Chain (BSC) – Fast transactions, EVM compatibility

- Polkadot – Cross-chain interoperability, secure parachains

- Avalanche – High throughput, low latency, customizable blockchains

2. Programming Languages

Solidity, Rust, Python, Node.js, Go (Golang), C++

3. Frontend & UI Frameworks

React.js, Next.js, Angular.js, Vue.js, Tailwind CSS, Bootstrap

4. Backend & API Frameworks

Web3.js, Ethers.js, Binance API, Coinbase API, Express.js, Nest.js, GraphQL, REST API, RabbitMQ, Kafka, Redis, PostgreSQL

How much does it cost to develop a hybrid crypto exchange software?

Cost to develop a hybrid crypto exchange software varies from $10,000 to $40,000 depending on various factors like complexity, blockchain and integrated features. A basic hybrid crypto exchange development with essential trading functionalities may cost on the lower end, while an advanced platform with liquidity aggregation, multi-layer security, and compliance integrations will require a higher investment.

How Do Hybrid Crypto Exchanges Make Money? (Revenue Streams)

1. Trading Fees

Hybrid exchanges charge a small fee on every trade executed on the platform. These fees can be fixed or dynamic based on trading volume, maker-taker models, or premium user tiers.

2. Withdrawal Fees

Users pay a fee when withdrawing cryptocurrencies or fiat from the platform. These fees vary depending on the blockchain network and transaction size.

3. Listing Fees for Tokens

Crypto projects pay a listing fee to get their tokens listed on the exchange, especially for premium placements and featured sections.

4. Subscription Models

Some hybrid exchanges offer VIP memberships or subscription plans, providing traders with lower fees, faster transactions, or premium support services.

5. Staking & Lending Options

Exchanges earn revenue by offering staking, yield farming, and crypto lending services, where users lock their assets to earn interest while the exchange takes a commission.

6. Market Making & Liquidity Services

Exchanges act as market makers by providing liquidity to trading pairs and earning a spread between bid and ask prices.

7. White-Label Solutions & API Access

Some exchanges offer white-label exchange solutions or charge for API access to traders, institutions, or developers building on top of the platform.

Why Choose Opris as Hybrid Crypto Exchange Development Company?

Building a hybrid crypto exchange requires expertise in blockchain, security, and trading infrastructure. Opris specializes in developing high-performance hybrid exchanges that combine the speed and liquidity of centralized exchanges with the security and privacy of decentralized platforms. Our team ensures a seamless development process, integrating cutting-edge technology, compliance standards, and user-centric features. With a strong track record in crypto exchange solutions, Opris is the ideal partner as a hybrid crypto exchange development company to launch a future-ready exchange.

Key Reasons to Choose Opris

Advanced Trading Engine

Institutional-Grade Security

Customizable & Scalable Solutions

24/7 Support & Maintenance

Start Your Hybrid Crypto Exchange with Opris!

Build a secure, high-performance hybrid exchange with Opris Exchange Development— trusted by businesses worldwide!

FAQ– Hybrid Crypto Exchange Development

1. What is a hybrid crypto exchange, and how does it work?

A hybrid crypto exchange combines the advantages of centralized (CEX) and decentralized (DEX) exchanges. It offers high liquidity and fast transactions like CEX while ensuring security and user control over assets like DEX. Hybrid exchanges use order matching algorithms for efficient trade execution and on-chain settlements for transparency.

2. How does a hybrid crypto exchange provide security for user funds?

A hybrid crypto exchange ensures security by integrating multi-layer encryption, two-factor authentication (2FA), cold storage for funds, and smart contract-based escrow. Additionally, KYC/AML compliance, DDoS protection, and end-to-end SSL encryption prevent unauthorized access and fraud.

3. What are the advantages of a hybrid crypto exchange over CEX and DEX?

- Liquidity & Speed – Uses centralized order matching for faster trades.

- Security & User Control – Allows users to retain ownership of assets like DEX.

- Low Fees – Reduces high gas fees seen in DEX transactions.

- Compliance & Trust – Adheres to KYC/AML regulations for institutional investors.

4. Does a hybrid crypto exchange require KYC/AML compliance?

Yes, a hybrid exchange requires KYC/AML compliance to prevent fraud, ensure regulatory adherence, and attract institutional investors. KYC verification ensures user identity validation, while AML policies help detect suspicious transactions and comply with financial regulations.

5. How much does it cost to develop a hybrid crypto exchange?

The cost of developing a hybrid crypto exchange depends on features, security protocols, liquidity integration, and compliance measures. On average, development costs range from $80,000 to $250,000, depending on customizations, blockchain network, and third-party integrations.

6. What are the revenue streams for a hybrid crypto exchange?

A hybrid exchange generates revenue through:

Staking & Lending – Provides passive income opportunities.

Trading Fees – Earns a commission on transactions.

Listing Fees – Charges projects to list tokens.

Withdrawal Fees – Applies fees for asset withdrawals.

Subscription Models – Offers premium trading tools.